Seminars

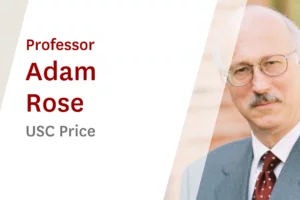

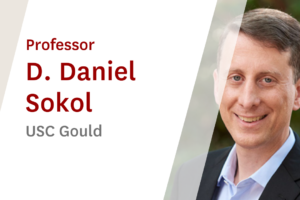

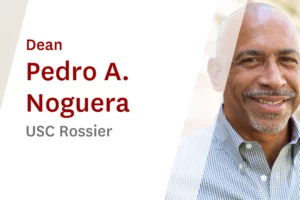

Access seminars from USC’s top minds.

Our broad (and growing) library of tuition-free short seminars bring you into conversation with a dynamic community of USC faculty, researchers, alumni and students.

Hear from our experts on

- Key professional insights

- Global challenges and possible solutions

- Industry-shaping trends

- Timely and wide-ranging topics

![Health & Well-Being: USC Online [Website] Seminar Thumbnails (1)](https://online.usc.edu/wp-content/uploads/2023/01/USC-Online-Website-Seminar-Thumbnails-1-300x200.png)

![Politics & Policy: USC Online [Website] Seminar Thumbnails (1)](https://online.usc.edu/wp-content/uploads/2021/10/USC-Online-Website-Seminar-Thumbnails-1-300x200.png)